$750 billion effort by Goldman Sachs led by David M. Solomon to help accelerate climate transition

Doing good and giving back to communities is becoming part of the business philosophy at the venerable 153-year-old firm under the leadership of CEO David M. Solomon.

Goldman Sachs Gives is an effort committed to fostering innovative ideas, solving economic and social issues, and enabling progress in underserved communities globally.

Through a donor-advised fund, Goldman Sachs’ current and retired senior employees work together to recommend grants to qualifying nonprofit organizations to help them achieve their goals.

A reflection of the firm’s ongoing commitment to philanthropy, Goldman Sachs Gives has made more than $2 billion in grants and partnered with 8,000 nonprofits in 100 countries around the world.

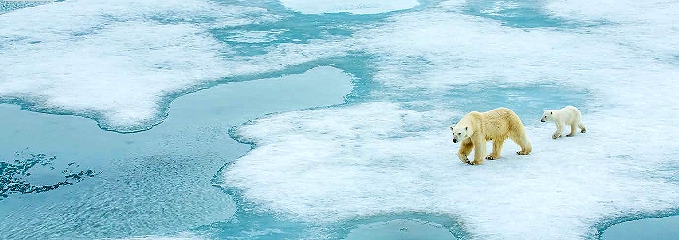

On the Environment front, Goldman Sachs is deploying $750 billion across investing, financing and advisory activities by 2030 and bringing commercial expertise to help clients accelerate climate transition and advance inclusive growth.

The firm focuses on unprecedented opportunities for clients to apply sustainable finance to make a global impact taking into consideration that renewable energy now accounts for a third of global power capacity, Millennials will inherit more than $50 trillion in the coming decades, total issuance of sustainable debt including green, social and sustainability bonds have surpassed $1 trillion.

Goldman Sachs leadership considers climate change a global challenge and their top priority.

They are actively helping industries transition operations and business models to help usher in a low-carbon economy.

Their efforts currently focus on: Clean Energy, Sustainable Transport, Sustainable Food & Agriculture, Waste & Materials and Ecosystem Services.

Funds managed by Goldman Sachs have been long-time supporters of Renew Power India, beginning from the fund’s early-stage investments in ReNew Power to the Investment Banking Division working on three green bonds totaling $1.3 billion.

On the path to helping ReNew Power become India’s largest independent renewable energy company, ReNew’s business growth has also contributed 4,000+ new jobs to the Indian economy across more than 95 villages. ReNew’s growth is playing a key role in India’s transition to a low-carbon economy.

Northvolt is a Sweden-based European supplier of sustainable, high-quality battery cells and systems, targeting the automotive and energy storage sectors. In 2019, Goldman Sachs, alongside Volkswagen Group and BMW, led a $1 billion equity capital raise for Northvolt.

This capital enables the construction of an initial 16GWh lithium-ion battery cell manufacturing capacity at Northvolt’s gigafactory in Sweden, Northvolt Ett, the first gigafactory in Europe. Northvolt’s “greenest battery on earth” is powered by 100% renewable electricity and is implemented through a localized and traceable supply chain with ambitions to pursue material recycling.

Twiga Foods is a Kenyan B2B food distribution company, recently raised $23.75 million in a series B equity round led by Goldman Sachs. Since its launch in 2014, Twiga has been building Kenya’s only end-to-end distribution for fresh and processed food.

The equity raised will fund the continued development of Twiga’s proprietary technology and logistics assets to support the rollout of its distribution system and lay the foundation for expansion into other cities on the African continent, thereby helping to drive sustainable access to lower cost higher quality food.

In 2018, funds managed by Goldman Sachs acquired Restaurant Technologies, Inc. Headquartered in Minneapolis, Restaurant Technologies provides a closed-loop system to commercial kitchens which is a safer, cleaner, sustainable and more efficient way to manage cooking oil.

Once used cooking oil is collected from customer locations by Restaurant Technologies, it is sold to producers of biofuels to be used as a feedstock in the production of such fuels. Restaurant Technologies has a diverse set of customers from independent restaurants to grocery stores and hospitality venues.

The Conservation Fund worked with Goldman Sachs to offer first-of-its-kind green bonds totaling $150 million.

Proceeds from the green bonds will be used to increase the scale of the “Working Forest Fund” dedicated to mitigating climate change, strengthening rural economies and protecting natural ecosystems through the permanent conservation of at-risk working forests. Working forests — forestland that is sustainably managed to supply a steady, renewable supply of wood for industry and consumer purposes — provide jobs and community benefits in addition to environmental protection.

CEO David Solomon outlined the new direction of his firm with the following words: “As a financial institution, we believe we can achieve the greatest impact in advancing the climate transition by partnering with our clients across our business. Whether it is by developing new sustainability-linked financing solutions, offering world-class strategic advice, or co-investing alongside our clients in cutting-edge clean energy companies, we’re constantly innovating and expanding new commercial capabilities to help our clients accelerate their transition.”

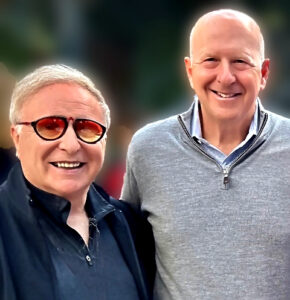

Photo: Goldman Sachs CEO David M. Solomon with Lifestyles Magazine/Meaningful Influence founder Gabriel Erem.